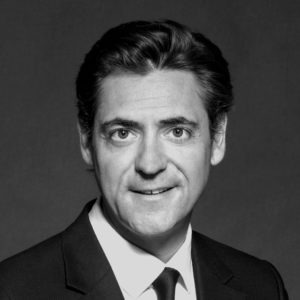

Matthieu Bordeaux-Groult is co-founder and CEO of ROCE Capital. Matthieu leads the business development and also supports the compliance functions. Previously, Matthieu was a Partner and European equity sales at Exane BNP Paribas in New York (2009-2015) and London (2015-2020). Within the research department, he participated in the origination and distribution of several IPOs. Matthieu began his career at Richelieu Finance (2005-2008) as a buy-side equity analyst and assistant fund manager for the Richelieu Special fund. Matthieu graduated from Institut Supérieur de Gestion in 2005.

About us

Founded in 2020 by Michael Niedzielski and Matthieu Bordeaux-Groult, ROCE Capital is an independent asset manager owned by its partners, who have been working closely together for over 10 years.

ROCE Capital SAS is based in Paris and is authorized and regulated by the French Financial Markets Authority (AMF) under No. GP-20000008.

We offer a simple and transparent investment product for private and institutional clients through one European equity fund: ROCE Fund.

Our DNA

Expertise

The team combines rich and complementary experiences in financial analysis and European equities.

Rigor

Investing in equities requires an established and rigorous process in which the ROCE is the cornerstone of our analysis.

Proximity

ROCE Capital is a long-term partner for its investors.

Our team

Michael Niedzielski

Michael Niedzielski is co-founder and fund manager of ROCE Capital. Previously he worked at T Rowe Price (2015-2020) advising the International Discovery Strategy (5-star Morningstar) on its European investments in small & mid-caps. Prior to T Rowe Price Michael was a senior analyst and sector fund manager at Fidelity Management & Research in Boston and London (2007-2015). Michael began his career at JP Morgan in London (2002-2004) within its M&A advisory department. Michael graduated with an MBA from Columbia Business School in 2007 and with a BA in economics from the University of Chicago in 2002.

Cyril Freu

Cyril Freu joined ROCE Capital in 2025 to manage the ROCE Large Cap fund. Cyril has over 25 years of experience in financial markets, notably at DNCA Finance (2009–2018), where he was Co-Chief Investment Officer and managed the Absolute Performance Equity range (€5 billion in assets under management). Prior to that, he held various positions at IXIS CIB (1998–2009), first as a sell-side equity analyst and later as a proprietary trader. More recently, he headed Financière Célovisée, an investment holding company active in both listed and private markets. Cyril holds a postgraduate degree (DESS) in Finance from Sciences Po Paris and Paris-Dauphine University. He is a member of ROCE Capital’s Executive Committee.

Christophe Billon

Christophe joined ROCE Capital in 2022 as a Financial Analyst. He is co-portfolio manager of ROCE Fund since September 2024. Previously, he worked as an equity analyst on European companies within BDL Capital Management (2017-2020) and Noria (2020-2022). He notably covered different sectors such as TMT, automobile and industrials. Christophe graduated from Paris-Dauphine university with a Master in Banking and Finance in 2016.

Tom Marchi

Tom Marchi joined ROCE Capital in 2024 as a Financial Analyst. He is also responsible for the company’s sustainable investment policy.

Previously, Tom worked as an analyst covering European micro, small, and mid caps, notably at Gay-Lussac Gestion and TP ICAP Midcap in Paris. He holds an MSc in Finance from NEOMA Business School and has passed the first two levels of the CFA program, as well as the CFA ESG certificate.

ROCE Fund

ROCE Capital deploys a single management strategy through the ROCE Fund, which invests in shares of European companies with the following characteristics:

We invest in companies that we know and whose business model we understand. The portfolio is concentrated and built around long-term convictions.

Alignment of interests between management and shareholders as well as good corporate governance are essential to our selection process.